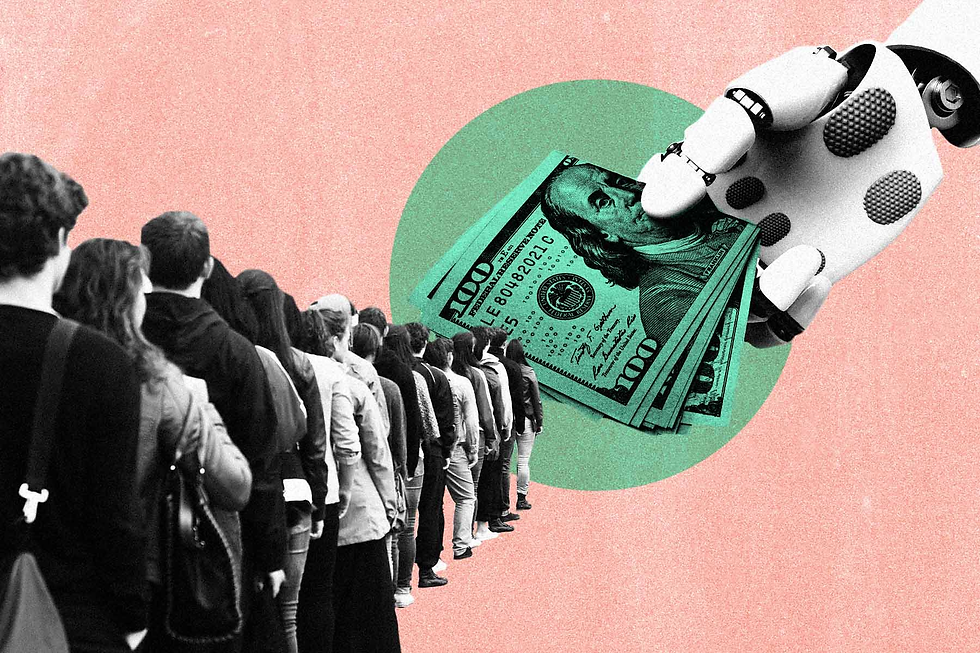

‘Godfather of AI’ Warns Artificial Intelligence Will Cause Massive Unemployment and Boost Corporate Profits

- Ethan Carter

- Sep 9, 2025

- 14 min read

Why the Godfather of AI warning about unemployment matters

Geoffrey Hinton’s public alarm—that the “Godfather of AI warns artificial intelligence will cause massive unemployment” and that the same technologies will “boost corporate profits”—is more than a provocative headline. It is a high‑profile signal from a pioneer whose work helped create the tools now reshaping the workplace, and it matters for policymakers, businesses, and workers alike because the stakes are economic, social, and political. Geoffrey Hinton left Google in 2023 to speak more freely about AI risks, and since then his warnings have sharpened debates about what rapid automation could mean for jobs, wages, and inequality. Fortune captured his core concern about an AI “nightmare scenario” where technology outpaces social and regulatory responses.

The practical stakes break into three time horizons. In the immediate term, entry level and routine positions face the clearest exposure to automation and generative AI augmentation. Over the medium term, employers may restructure labor demand across whole sectors, shifting the composition of available work and the skills valued in the economy. And in the long term, debates about Artificial General Intelligence (AGI) raise deeper questions about labor, governance, and whether automated systems could perform a wide range of cognitive tasks previously reserved for humans.

This article synthesizes reporting, industry statements, consulting analyses, and peer‑reviewed research to meet EEAT standards: it references public statements by key figures, consulting and market studies, academic preprints, and mainstream reporting so readers can judge evidence and uncertainty. I walk through mechanisms by which “AI could cause massive unemployment,” explain why corporate profits might soar even as jobs decline, profile industry voices (including Hinton and corporate leaders), examine academic scenarios for AGI and employment, and review policy responses—such as Universal Basic Income and shared‑prosperity frameworks—that scholars and practitioners are proposing.

Key takeaway: Hinton’s warning is a credible alarm that should spur practical planning. The question is not whether AI will change work—that is already happening—but how societies choose to distribute gains so that automation does not only boost corporate profits while leaving many workers behind.

How artificial intelligence could cause massive unemployment, explained

AI could cause massive unemployment through several mechanisms that systematically reduce labor demand. At root, modern machine learning and generative models automate tasks once thought to require human judgment, and they do so at scale and at falling marginal cost. That creates three pathways to broad displacement: direct task automation, augmented automation that replaces human oversight, and cascading demand reductions as whole business models evolve. Below I outline these mechanisms, the workers most at risk, and how turnover (job churn) differs from permanent disappearance.

Automation of entry level work and routine tasks

Entry level jobs sink first because they concentrate repeatable tasks that are easiest for algorithms to learn. Entry level roles in customer service, data entry, routine financial processing, and content moderation often follow scripts or patterns that can be encoded or learned from data. This is why several consulting analyses and job posting trackers now report declines in entry‑level job postings after rapid AI deployment in hiring and screening workflows. Industry reports have begun documenting an observable fall in low‑skill job listings as employers pilot automation. For workers, that means fewer stepping stones into the labor market and stronger competition for remaining positions.

Insight: entry level roles serve as career on‑ramps—when those on‑ramps close, economic mobility suffers.

Rapid improvements and displacement velocity

AI could cause massive unemployment faster than earlier waves of automation if capability gains compound quickly. Recent years have seen steep improvements in generative models, prompting some experts to warn of compressed timelines for large‑scale displacement. Extreme projections—such as headlines about “99 percent job loss by 2030”—are useful as stress tests of assumptions but are outliers in expert surveys; they illuminate the upper bound of a debate about pace more than they represent mainstream consensus. Coverage of such extreme scenarios has entered public discourse to highlight how rapidly dynamics could shift under optimistic capability growth. Still, more moderate scenarios projecting major disruption over the next decade are widely considered plausible by many economists and technologists.

Sectoral examples of likely job losses

AI unemployment in customer service and retail will likely be among the earliest, most visible impacts. Chatbots, voice assistants, and automated checkout systems target routine interactions; in media, generative tools can produce first drafts of reporting or marketing copy; in finance, algorithmic processing displaces data‑entry and basic analysis. Manufacturing administrative roles—scheduling, procurement, and back‑office functions—are also vulnerable as software integrates more end‑to‑end. These sectoral losses do not affect everyone equally: workers with narrow, routinized roles bear the highest risk, while those in jobs requiring complex interpersonal judgement or advanced creative and contextual reasoning show more resilience.

Distinguishing redistribution from net destruction is important. Some roles will vanish entirely; others will be redefined as humans move to more supervisory or creative duties. Labor market churn can generate opportunities, but without deliberate policy and corporate choices, displacement could outpace re‑employment pathways, producing net job loss for sizeable groups.

Why corporate profits may soar while jobs decline

When AI substitutes for labor, the gains often accrue to capital rather than labor. Software scales with low incremental cost: a model trained once can be deployed to millions of users, producing revenue without proportionate increases in payroll. That difference drives margin expansion for firms that successfully integrate AI into products and operations.

Productivity gains and margin expansion for firms

AI driven productivity fuels corporate profits by raising output per worker and enabling firms to broaden services without proportional headcount increases. Automated customer service handles more volume at lower cost; algorithmic personalization can increase sales conversion; and internal automation reduces administrative overhead. These effects show up in corporate accounting as higher revenue per employee and rising margins. Financial analysis has begun to tie AI deployment to an upward trend in corporate profitability and widening income shares, indicating that firms capturing AI efficiencies can generate outsized returns for shareholders and executives.

Concentration of gains and market power

Concentrated corporate profits from AI follow naturally from winner‑take‑most dynamics. Large platforms that control data, models, and distribution channels can extend incumbency advantages: richer data yields better models, better models attract more users, and scale begets further data. This feedback loop centralizes market power and the economic rents associated with AI capabilities. Firms that own the critical models and datasets can extract value across sectors, purchasing or outcompeting smaller rivals and capturing a disproportionate share of gains.

Consulting and market studies on entry level job decline

Consulting firms have documented patterns consistent with “entry level jobs sink,” showing declining hiring for junior roles even as firms report revenue growth. These studies often find that automation is selectively adopted first in cost‑sensitive, routine areas, precisely where entry‑level workers are concentrated. The result is a bifurcation: firms post higher profits while younger or less‑skilled workers face tougher labor market entry conditions. The effect is distributional: without interventions, the benefits of AI deployment risk accruing to investors and management more than to rank‑and‑file employees.

Key takeaway: Productivity does not automatically translate into shared prosperity; institutional choices about wages, bargaining power, and taxation determine distribution.

Industry voices and expert warnings, including the Godfather of AI

Voices across the AI ecosystem frame the technology’s risks differently. Some warn of rapid job losses and inequality; others emphasize innovation’s potential to create new work. Understanding these perspectives helps clarify where consensus exists and where debates remain unresolved.

Geoffrey Hinton, why his warning matters

Hinton warns AI will cause massive unemployment as part of a broader concern about societal impacts, and his credibility rests on decades of foundational work in neural networks. Hinton’s decision to leave Google was motivated by a desire to speak more openly about AI’s societal risks, and in interviews he has emphasized scenarios in which automation displaces many forms of labor and concentrates wealth. His stature elevates the policy conversation—when a founder figure articulates risks, regulators and the public pay attention in ways they might not for less prominent voices. Hinton’s core point is straightforward: the technical possibility of large‑scale automation demands public deliberation on economic policy and safety.

Jensen Huang and corporate leadership perspective

Not all industry leaders share Hinton’s emphasis on near‑term societal risk. Nvidia’s Jensen Huang has warned that job losses depend on whether human innovation keeps pace—often summarized as “jobs lost if world runs out of ideas.” Reporting captures his caveat that human creativity and new industries can offset some displacement. That view stresses demand‑side dynamics: new products and services enabled by AI could create roles that are hard to foresee today, though those jobs may require different skills.

Other experts and alarmist scenarios

Some commentators offer more extreme timelines. For example, thinkers like Roman Yampolskiy and others have proposed upper‑bound scenarios—such as widespread automation within a decade—that, while contentious, force societies to take seriously the risks of rapid capability growth. These scenarios sometimes invoke headline figures like “99 percent job loss by 2030” to probe worst‑case dynamics. Coverage of such projections highlights the spectrum of expert opinion and the need to treat extreme estimates as stress tests rather than forecasts.

Investor and public‑policy voices add further nuance. Macro investors and commentators—like Paul Tudor Jones—have framed AI as both an economic opportunity and a systemic risk to employment and social stability. The diversity of perspectives shows that the debate is not binary: it is a conversation about pace, policy, corporate governance, and the social contract.

Research, AGI scenarios, and long term economic risks

Academic work tries to move beyond headlines by formalizing how AI capabilities could reshape labor and macroeconomics. Research ranges from near‑term analyses of task automation to AGI‑focused models that explore systemic economic transformation.

AGI and human employment in recent academic work

Peer‑reviewed and preprint papers examine how an AGI capable of performing a broad range of cognitive tasks could affect employment and productivity. Some models suggest significant displacement if AGI attains competencies that substitute for professional and managerial work; others stress that complementarities between humans and AI could preserve many roles. For a synthetic overview of how AI may affect society over coming decades, see commentary and modeling that maps capability progress onto socioeconomic outcomes. More recent AGI‑oriented papers model pathways where powerful autonomous systems transform production processes and labor markets in ways that require proactive policy responses; these papers emphasize both the magnitude of potential change and the deep uncertainties about timing and adaptiveness. An example AGI impacts study explores economic transitions and policy options under different capability trajectories.

Modeling uncertainties and time horizons

Why do forecasts diverge so widely? Models vary by definitions (what counts as a task), assumptions about how firms adopt technology, how consumers react, and how fast capabilities improve. The difference between “displacement” and “redefinition” of jobs matters too: task‑based models often predict which activities become automated, but real jobs bundle many tasks, some automatable and others not. Economic adaptation—new industries, regulatory choices, and investment patterns—further complicate projections. In short, “AI job displacement timelines” can run from near‑term (5–10 years in targeted sectors) to multi‑decadal or conditional AGI scenarios.

Scholarly proposals for shared prosperity frameworks

To address distributional risks, researchers propose revenue sharing, taxation of AI rents, public ownership or licensing of key models, and stakeholder governance mechanisms. These “shared prosperity in the age of AI” proposals aim to capture some of the value created by AI and direct it toward social goods—reskilling, income supports, or public investment in job creation. Scholars have published frameworks advocating for institutional redesign to ensure AI benefits are broadly shared. These proposals are diverse in mechanism and politically challenging, but they represent an active scholarly consensus that policy action matters for outcomes.

Policy responses and safety nets for shared prosperity

If “AI will cause massive unemployment if unchecked,” then public policy and corporate governance will determine whether gains are widely shared or concentrated. This section examines prominent policy options and the tradeoffs involved.

Universal Basic Income, proponents and practical challenges

UBI to mitigate AI unemployment has become a focal idea. Proponents argue that an unconditional cash floor can decouple income from employment during structural transitions, providing stability while people retrain or re‑enter the labor market. Some commentators, including Hinton in media discussions, have mentioned UBI as part of the policy conversation. Critics point to funding challenges, political feasibility, and the risk of inadequate design. Evidence from UBI pilots is mixed: small‑scale trials show benefits in financial security and well‑being, but scaling a credible national program requires sustainable revenue sources and careful calibration to avoid inflationary pressures or labor market distortions.

Labor market policies and reskilling initiatives

Reskilling for AI era work is a more targeted policy lever. Programs that finance training, portable benefits, wage insurance, and job transition services can help workers adapt. Importantly, reskilling must be demand‑driven: training programs succeed when aligned with employer needs and when pathways to quality jobs exist. Public‑private partnerships that tie training to guaranteed hiring or apprenticeships tend to show better outcomes than generic courses. However, reskilling alone does not address the aggregate income effects if job quantity shrinks substantially.

Policy frameworks from academia for equitable AI gains

Shared prosperity frameworks for AI include proposals to tax AI rents, require profit‑sharing with affected workers, or create public ownership stakes in foundational models. These measures aim to capture some of the economic surplus generated by automation and redirect it toward social goods. Academic proposals have outlined mechanisms to redistribute AI value, from targeted taxes to novel governance structures for large models. Implementing them raises practical questions about measurement (how to identify AI rents), enforcement, and international coordination to avoid capital flight.

Case studies, consulting analyses, and business challenges

Real‑world examples ground the debate. Consulting reports and corporate case studies show patterns of entry‑level decline alongside rising margins in firms aggressively deploying AI.

Consulting reports on recruiting and entry level roles

A number of studies track hiring patterns and report a decline in entry level job postings in industries that adopt automation tools. Analyses tracking recruitment data highlight reductions in junior role listings even as firms report efficiency gains. These reports do not prove causation in every instance—macroeconomic conditions, demographic shifts, and corporate strategy also matter—but they provide early empirical signals that automation changes the composition of hiring.

Corporate examples of AI lift to margins

Public companies adopting AI often report higher productivity metrics: lower cost per transaction, faster processing, and improved personalization. In some retail and financial firms, automation has reduced the need for back‑office headcount, helping margins even as revenue grows. Commentators have tied investor expectations and corporate earnings to AI adoption, arguing that AI boosts corporate profits by lowering marginal labor costs and scaling services. Where firms have broad market power, these profit gains compound wealth concentration.

Worker outcomes and company responses

Some companies have invested in retraining and redeployment, offering transition programs or internal rotation to retain employees in higher‑value roles. Others have opted for layoffs without robust support, generating reputational risk and social backlash. Public essays and investor commentary highlight that companies face both opportunity and responsibility when deploying technologies that displace workers. Monitoring long‑term worker outcomes requires longitudinal data that few firms publicly disclose, creating an evidence gap around whether reskilling approaches scale effectively.

Limitation: case studies show plausible links between AI deployment and changing labor demand, but they are snapshots. Longitudinal, cross‑industry research is needed to quantify net effects on employment and wages.

Challenges for businesses and workers, and practical mitigation strategies

As firms adopt AI, they confront operational and ethical dilemmas. Workers need pragmatic steps to navigate shifting demand. Below are actionable strategies for both.

Business playbook to reduce harm while adopting AI

Responsible AI deployment to limit unemployment requires planning. Companies can conduct impact audits, phase automation to allow internal redeployment, maintain human‑in‑the‑loop systems for sensitive tasks, and create worker transition funds financed by efficiency savings. Transparent impact assessment and clear communication with employees and communities reduce reputational risk. Where feasible, pilot automation in partnership with labor representatives to co‑design transitions.

Worker strategies and government supports

For individuals, reskilling to avoid AI job loss means focusing on AI‑complementary skills: creativity, complex problem solving, domain expertise, and social intelligence. Collective bargaining remains a powerful lever: unions can negotiate profit‑sharing or job protection clauses tied to automation deployments. Public supports—portable benefits, wage insurance, subsidized retraining—help cushion transitions. Financial planning and portfolio careers (mixing gig, freelance, and salaried work) increase resilience.

Cross sector coordination and regulatory levers

Regulation to prevent concentrated AI profits may include transparency requirements for model use, taxation of algorithmic rents, or mandates for profit‑sharing with displaced workers. Industry consortia can set norms for impact disclosure and worker transition support. International coordination matters because capital mobility can undercut national redistribution efforts; coordinated standards and reciprocal enforcement can make national policies more effective.

Insight: combining corporate responsibility with policy incentives yields better outcomes than relying on either alone.

FAQ

Will AI really cause massive unemployment? Short answer: possible in specific sectors and timelines; magnitude is uncertain and depends on corporate choices, policy responses, and how quickly AI capabilities advance. High‑profile warnings—such as those from Geoffrey Hinton—underscore credible risks, while other leaders emphasize innovation‑driven job creation. Hinton’s public statements and departure from Google crystallized this debate.

Who is most at risk from AI job displacement? Workers in entry level and routine task roles face the highest near‑term risk: customer service, data entry, basic media production, retail checkout, and administrative roles. Workers with narrowly defined, repetitive tasks are most exposed, while those with complex interpersonal, creative, or strategic responsibilities are relatively insulated.

Could AI benefits be redistributed to avoid inequality? Yes, through policies like progressive taxation on AI rents, profit‑sharing schemes, public ownership or licensing of foundational models, and targeted social programs. Each option has political and technical challenges, and researchers offer diverse frameworks for capturing and redistributing AI value (scholarly proposals are emerging).

Is Geoffrey Hinton’s warning credible? Hinton’s credentials and role in creating modern neural networks give weight to his concerns. He left Google to speak more freely about societal impacts and has publicly warned of unemployment and inequality risks—views that are taken seriously by policymakers and researchers. His statements helped elevate public debate, but they are part of a broader conversation with differing expert views.

How soon could major job losses happen? Time horizons vary: some targeted sectoral impacts are already visible; broader disruptions across many white‑collar fields could take 5–15 years depending on investment and adoption speed; AGI‑style transformations are more speculative and dependent on breakthrough timelines. Extreme projections (e.g., “99 percent job loss by 2030”) exist mainly as stress tests rather than consensus forecasts (coverage of extreme scenarios highlights the range of views).

What can companies do to share profits and protect workers? Firms can implement retraining programs, redeployment pathways, phased automation with worker transition funds, and profit‑sharing mechanisms that allocate some efficiency gains to employees. Transparency and dialogue with labor representatives improve legitimacy and outcomes.

Are there successful city or country pilots for mitigating AI unemployment? There are UBI and reskilling pilots worldwide with mixed results: small UBI trials show improved well‑being but limited evidence on large‑scale labor market impact; targeted apprenticeship and employer‑linked training programs show better placement outcomes. Evidence gaps remain for large‑scale mitigation of automation shocks.

How should individuals prepare for an AI driven job market? Focus on lifelong learning, pursue AI‑complementary skills (domain expertise, complex judgment, people management), build financial buffers, and engage in collective action (unions, professional networks) to negotiate fair transition terms.

If unchecked, AI will cause massive unemployment — a roadmap for policymakers, business leaders, and workers

Geoffrey Hinton’s warning that AI will cause massive unemployment and boost corporate profits functions as an urgent prompt, not a deterministic prophecy. The evidence shows clear mechanisms—automation of routine tasks, rapid capability gains, and winner‑take‑most economics—that could produce growing inequality unless mitigated. But outcomes are not preordained: they depend on choices made by firms, regulators, workers, and international institutions.

Over the next 12–24 months, the most actionable monitoring metrics are concrete and measurable: trends in entry level job postings, changes in revenue‑per‑employee for major employers, the pace of AI deployment across customer‑facing services, and early results from reskilling pilots. Policymakers should pair short‑term buffers (wage insurance, targeted retraining, temporary wage subsidies) with experimentation on longer‑term revenue sharing and redistribution mechanisms (pilot UBI programs, taxes on AI rents, or public ownership stakes in key models). Businesses should commit to transparent impact assessments, phased automation strategies that allow redeployment, and profit‑sharing or transition funds to align incentives.

For workers and communities, the roadmap is both defensive and aspirational: acquire AI‑complementary skills, build networks that facilitate labor market mobility, and organize to secure a share of productivity gains. Collective bargaining and public regulation are complementary levers: market incentives alone will underdeliver on distributional fairness.

Research priorities should focus on longitudinal, cross‑industry data to quantify net employment effects; rigorous evaluation of retraining and UBI pilots; and operational metrics that tie AI deployment to labor outcomes. International coordination is essential to prevent a race to the bottom on taxation and to share best practices for governance of foundational models.

If societies act proactively—combining immediate transition supports with structural reforms to capture and redistribute AI rents—the benefits of automation need not accrue only to capital. Instead, the same technologies that threaten to concentrate wealth could be governed to expand shared prosperity. If left unchecked, the scenario Hinton warns about—where AI will cause massive unemployment and boost corporate profits—becomes much more likely. The choice now is to design policies and corporate norms that steer technological progress toward broadly beneficial ends rather than concede gains to a narrow set of owners.