Why Most AI Startups Are BAD Businesses: The Economics Reality Behind the Hype

- Aisha Washington

- Sep 19, 2025

- 7 min read

The artificial intelligence revolution has captured imaginations and venture capital at unprecedented levels, with U.S. private AI investment hitting $109.1 billion in 2024. However, beneath the glossy headlines and astronomical valuations lies a harsh economic reality: most AI startups fundamentally operate as poor businesses with unsustainable unit economics. Unlike the profitable SaaS giants that preceded them, AI-native companies face structural challenges that make long-term profitability elusive for all but the most strategically positioned players.

The Flawed Economics of AI-Native SaaS

The Stark Margin Difference

The foundation of any sustainable software business lies in its gross margins—the percentage of revenue remaining after subtracting direct costs of goods sold. Traditional B2B SaaS businesses have long enjoyed the luxury of gross margins between 70-90% , with industry leaders like Adobe achieving ~88%, GitLab ~88%, and Paycom ~85%. This remarkable profitability stems from software's fundamental characteristic: once built, the marginal cost to serve additional customers approaches zero.

AI-native companies operate under completely different economics. Current industry analysis shows that AI-centric companies typically operate with gross margins in the 50-60% range , with even leading foundation model companies struggling to achieve better margins. Anthropic, despite raising billions of dollars, reportedly operated with gross margins of only 50-55% in late 2023. This margin compression represents more than a minor adjustment—it fundamentally alters the economic viability of AI businesses.

The Unsustainable Cost Structure

Unlike traditional software where serving additional users incurs negligible costs, every AI interaction generates substantial and continuous operational expenses. These include compute costs, data fees, and increased human resources. The economics become particularly challenging when examining specific case studies of major AI products.

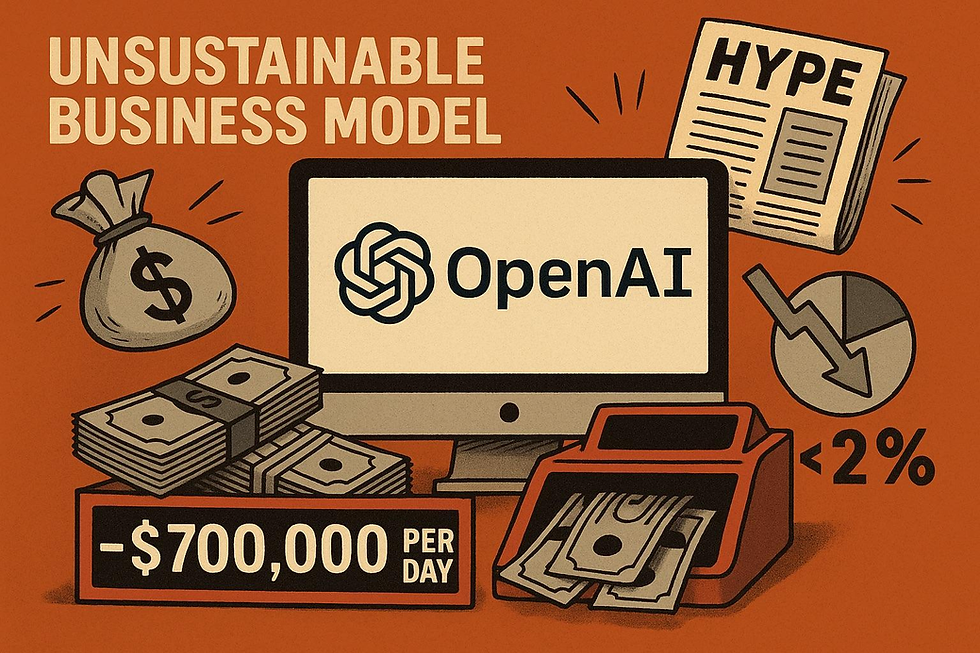

ChatGPT's daily operating costs range between $100,000 and $700,000 , translating to $3-21 million per month. The platform operates on Microsoft's Azure Cloud infrastructure, which charges around $3 per hour for a single A100 GPU cluster. OpenAI CEO Sam Altman has acknowledged these realities, stating that "the compute costs are eye-watering" and that the company must "monetize it somehow at some point."

GitHub Copilot presents an even starker example of unsustainable unit economics. The service was reportedly losing an average of $20 per user per month in early 2023 , with some power users costing the company up to $80 per month while paying only $10 monthly subscriptions. This represents a fundamental inversion of traditional software economics, where heavy users typically generate more profit, not larger losses.

A Product Manager's Reality Check on Metrics and Conversion

Situating AI in the Technology Hype Cycle

The current generative AI boom bears striking similarities to previous technology hype cycles, particularly blockchain and augmented reality. The Gartner Hype Cycle maps emerging technologies through five phases, with most currently hyped technologies reaching the "Peak of Inflated Expectations" before inevitably descending into the "Trough of Disillusionment." Historical precedents suggest that revolutionary hype rarely correlates with immediate business viability.

The AI hype cycle appears to be tapering off, with consequences of rushed implementations becoming more visible. Much like the blockchain frenzy that preceded it, the AI boom has generated enormous investment and attention while producing relatively few sustainably profitable business models.

Examining ChatGPT's Conversion Reality

Despite ChatGPT's massive user base and cultural impact, its business metrics reveal concerning underlying trends. OpenAI reports about 250 million weekly active users and converts free customers to paid subscriptions at a rate of 5-6%. While this conversion rate exceeds some earlier estimates, it still means that over 94% of users generate pure costs without contributing revenue.

The financial implications are staggering. According to recent estimates, OpenAI generates approximately $1 billion per month in total revenue but faces estimated costs of $1.17 billion monthly , resulting in a monthly burn rate of about $167 million. This represents a fundamental challenge: the majority of users consume expensive computational resources while contributing nothing to revenue.

The Strategic Response to Unsustainable Economics

Interestingly, some observers note that OpenAI may be deliberately reducing model quality to control costs. Evidence includes "reduced context windows, shorter replies, and drops in overall utility" as the company struggles to balance service quality with financial sustainability. This represents a concerning precedent: AI companies may be forced to degrade their core product offerings to achieve viable unit economics.

Framework for Identifying Sustainable AI Startup

The Ultimate Litmus Test for AI Viability

The fundamental question for evaluating any AI startup's long-term potential is deceptively simple: would the product create value even without AI? Sustainable AI businesses use artificial intelligence as a feature that automates or enhances pre-existing valuable products, rather than building their entire value proposition around AI capabilities.

This framework helps distinguish between companies riding the AI hype wave and those solving genuine business problems that happen to benefit from artificial intelligence. The most viable AI startups today operate in specific industries like accounting, HR, or legal, handling large amounts of text-based data. While these represent sustainable businesses, they typically don't achieve the billion-dollar unicorn valuations that venture capital markets demand.

Where Real Opportunities Exist

The genuinely transformative AI opportunities lie in solving complex, effort-intensive problems in legacy industries. Companies are using AI to deliver value to customers while boosting sustainability, improving financial and sustainability results, reducing operational risk, and building operational digital twins. These applications focus on automating difficult analytical, consulting, or negotiation work rather than simple task automation.

Successful AI implementations often target specific operational challenges: optimizing resource utilization, reducing waste, improving supply chain efficiency, and enhancing decision-making processes. Companies like Ikea have built AI recommendation engines that tailor product suggestions based on sustainability preferences , with 20% of interactions driving website traffic and 5% converting to transactions.

Building Trust Through Fundamental Business Principles

Focus on Value Creation Over Hype

The AI industry's obsession with user acquisition and growth metrics often overshadows more fundamental business health indicators. While 74% of companies struggle to achieve and scale value from AI adoption , the sectors showing genuine AI leadership include fintech, software, and banking—industries that focus on solving specific, measurable problems.

Successful AI businesses prioritize retention and conversion rates over vanity metrics like weekly active users or total interactions. Thanks to venture funding, AI startups can survive with 50-60% gross margins in the near term , but this approach essentially subsidizes customers with investor money while hoping to reach scale or achieve technical improvements that increase margins.

The Sustainability Imperative

Long-term AI business success requires alignment with broader sustainability and operational efficiency goals. Companies implementing sustainable AI strategies focus on building digital maturity, implementing long-term roadmaps, cultivating internal competence, enforcing ethical standards, and evaluating impact beyond financial ROI.

The most promising AI applications contribute to multiple Sustainable Development Goals including quality education, decent work, industry innovation, reduced inequalities, responsible consumption, climate action, and strong institutions. This comprehensive approach suggests that sustainable AI businesses must create value across multiple dimensions, not simply optimize for short-term user engagement.

The Path Forward for AI Entrepreneurship

Accepting the New Economic Reality

AI entrepreneurs must accept that their businesses will operate with fundamentally different economics than traditional software companies. Current AI startup valuations range from median $3.6M for pre-seed to $10.0M for seed-stage companies , but these valuations must be justified by business models that account for ongoing operational costs.

The industry is responding with various pricing strategies including usage tiers, premium plans, pay-as-you-go credits, and outcome-based contracts. This experimentation reflects a fundamental shift toward stronger alignment between price, value, and cost than traditional software models typically required.

Strategic Applications That Work

The most successful AI applications focus on specific domains where computational intelligence provides clear, measurable value. Examples include AI-powered carbon measurement platforms for supply chain sustainability, geospatial tools for economic forecasting in emerging markets, and educational technology solutions for underserved communities.

These applications succeed because they solve genuine problems that existed before AI and use artificial intelligence to dramatically improve solution quality or reduce solution cost. They avoid the trap of being "AI solutions looking for problems" and instead represent "problems that benefit significantly from AI capabilities."

Frequently Asked Questions

Q: Are all AI startups doomed to fail? A: Not necessarily. AI startups that use artificial intelligence to enhance pre-existing valuable products, rather than building their entire value proposition around AI, can achieve sustainability. The key is solving real problems that would exist even without AI, using artificial intelligence as a powerful tool rather than the entire solution.

Q: Why do AI companies have such low margins compared to traditional software? A: Every AI interaction generates substantial ongoing costs including compute resources, API calls, and data processing. Unlike traditional software where serving additional users costs almost nothing, AI applications consume expensive computational resources for every user interaction, fundamentally changing the cost structure.

Q: How can investors identify sustainable AI businesses? A: Apply the litmus test: would this product solve a meaningful problem without AI? Sustainable AI businesses typically operate in specific industries with complex data processing needs, focus on operational efficiency rather than user engagement metrics, and demonstrate clear value creation that justifies their operational costs.

Q: What industries offer the best opportunities for AI startups? A: The most promising sectors include fintech, software, and banking, which show the highest concentration of AI leaders. Additionally, industries dealing with large amounts of structured data like accounting, legal, and HR present viable opportunities, though these may not achieve unicorn-level valuations.

Q: How long will AI startups need to operate with low margins? A: Industry experts expect AI startup costs to decline over time, but companies must explain their path to higher SaaS-like margins. The timeline depends on technological improvements in computational efficiency and companies' ability to optimize their cost structures while maintaining service quality.

Q: Is the AI hype cycle ending? A: The AI hype cycle appears to be tapering off, with consequences of rushed implementations becoming more visible. This follows historical patterns similar to blockchain and AR, where revolutionary promises often exceed immediate business viability. However, this doesn't eliminate opportunities for well-positioned companies solving genuine problems.

The AI revolution will undoubtedly transform numerous industries, but success will belong to companies that master the fundamentals of sustainable business models rather than those riding the hype wave. The future belongs to "boring, profitable businesses" that happen to use artificial intelligence effectively, not AI solutions desperately searching for sustainable problems to solve.